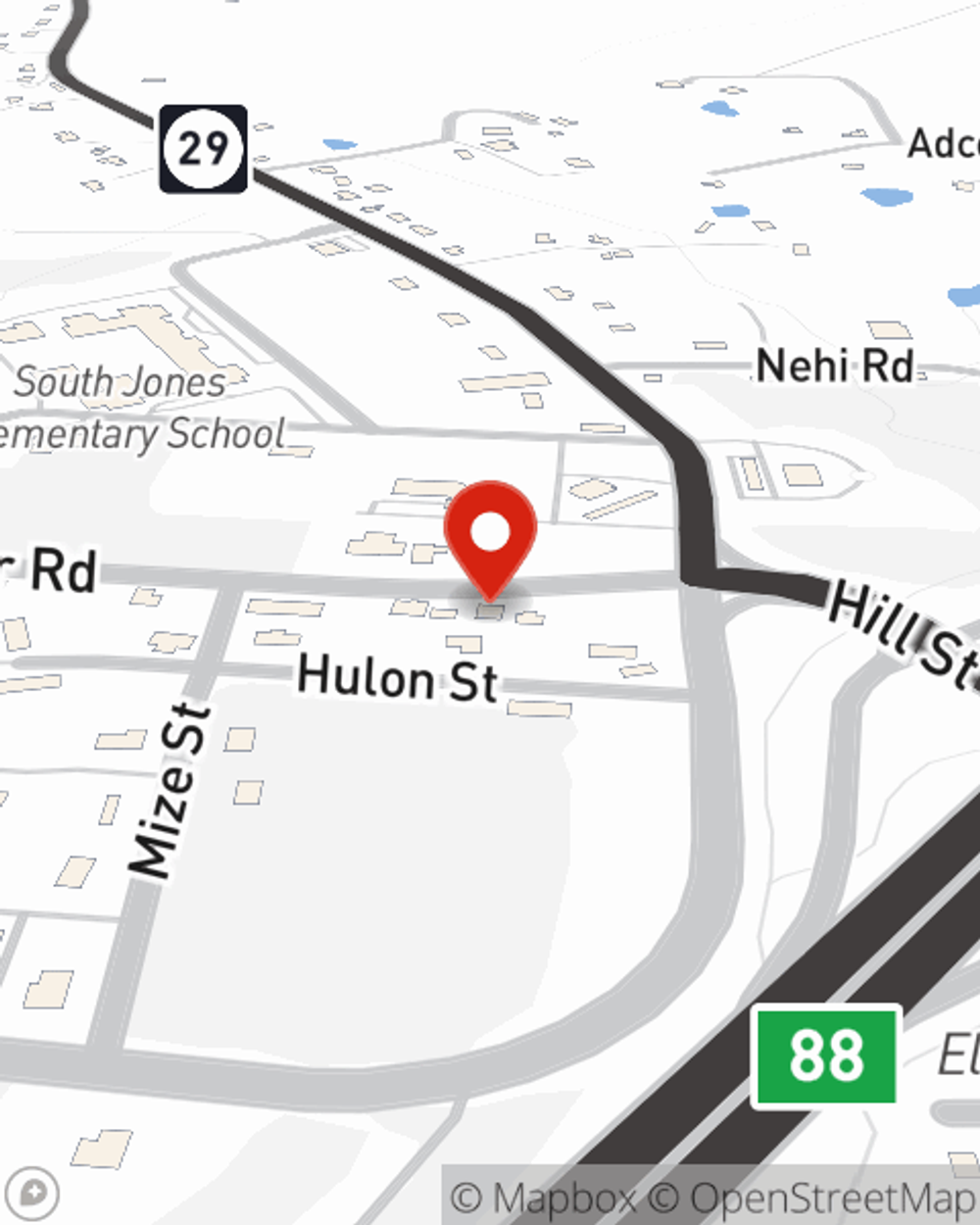

Renters Insurance in and around Ellisville

Ellisville renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Ellisville, MS

- Jones County

- Laurel, MS

- Moselle

- Hometown

- Jones College

- Forrest County

- Wayne County

- Jasper County

- Howard Industries

- Wayne Sanderson

Home Sweet Home Starts With State Farm

Home is home even if you are leasing it. And whether it's a condo or a townhome, protection for your personal belongings is good to have, whether or not your landlord requires it.

Ellisville renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Protect Your Home Sweet Rental Home

Renters rarely realize how much money they have tied up in their possessions. Just because you are renting a apartment or home, you still own plenty of property and personal items—such as a tablet, laptop, TV, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why get renters insurance from Jim Clark? You need an agent who wants to help you choose the right policy and examine your needs. With competence and efficiency, Jim Clark is waiting to help you keep your belongings protected.

Call or email Jim Clark's office to learn more about how you can benefit from State Farm's renters insurance to help keep your personal property protected.

Have More Questions About Renters Insurance?

Call Jim at (601) 477-9336 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.